salt tax repeal march 2021

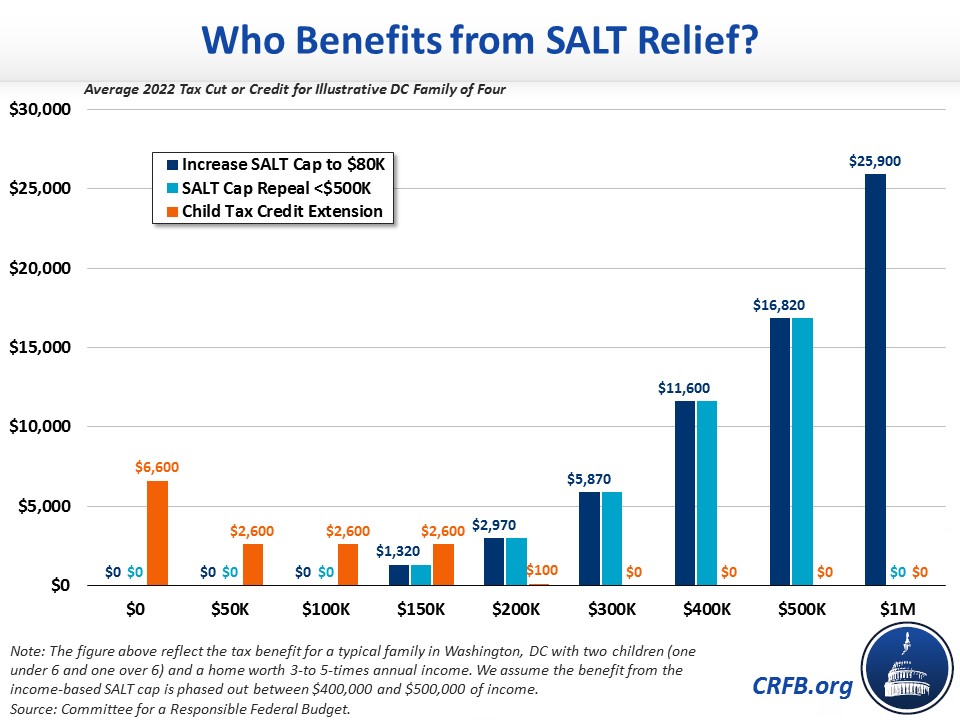

While 96 percent of the repeals savings would go to the top fifth of earners the middle 60 percent of earners would save an average of 27 annually Brookings found. No SALT no deal.

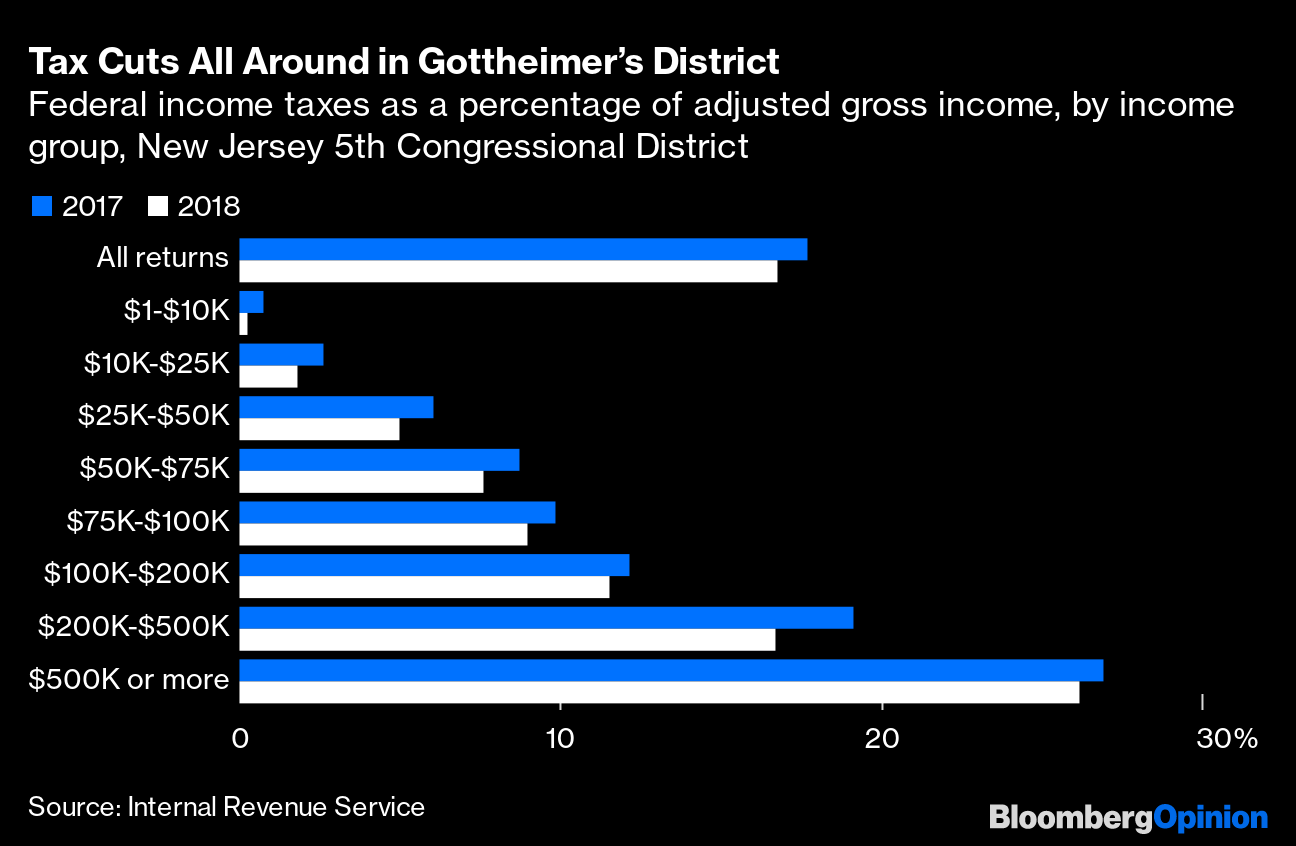

Salt Cap Repeal Will Be Just Another Nice Thing For High Earners Bloomberg

Calls by some New Jersey Democrats to.

. Salt Tax Cap Repeal 2021. Tom Suozzi NY-03 US. U S Lawmakers Pepper Congress With Pleas For Salt Tax Break.

For your 2021 taxes which youll file in 2022 you can only itemize when your. Last year Democrats proposed lifting the cap on the SALT deduction for 2020 and 2021 as part of a COVID-19 relief package arguing that it would provide relief to people hit. By Ana Radelat November 4 2021 900 am.

Starting in 2021 through 2030 the salt deduction limit is increased to 80000. During 2021 at least three states will enact legislation allowing for new sin taxes legalization of marijuana andor sports betting or adopting millionaire taxes. Mondaire Jones NY-17 US.

The tax cuts and jobs act imposed a 10000 cap on the itemized deduction for state and local taxes from 2018 through 2025. Mondaire Jones NY-17 US. Expansion of salt cap workaround.

Today Congressman Tom Suozzi D-Long Island Queens issued the following statement. Over 50 percent of this reduction would accrue to. According to press reports policymakers are considering adding a five-year repeal of the 10000 cap on the State and Local Tax SALT deduction to their Build Back Better.

Various proposals are under discussion in Congress this week. Elrich says not so fast on SALT tax cap repeal. A number of local Congress members were at the home of a White Plains homeowner Thursday to call for a repeal of the 10000 cap on state and local tax deductions.

52 rows The SALT deduction is only available if you itemize your deductions using Schedule A. Repealing the SALT cap in 2021 would reduce federal income tax liability by approximately 91 billion or 72 percent. A handful of house.

The House Ways and Means Committee is slated to clear the tax portions of President Joe Bidens stimulus legislation on Friday. Salt tax repeal march 2021 Saturday October 8 2022 Salt Tax Cap Repeal 2021. The bill would have raised the cap to 20000 for joint returns for 2019 and eliminated it for 2020 and 2021 for taxpayers with incomes below 100 million.

I am not going to support any change in the tax code unless. The three lawmakers say that the 10000 limit on SALT tax write-offs which was passed in former President Donald Trumps 2017 tax law has hurt residents of their districts. Jamaal Bowman NY-16 and Westchester County Executive George Latimer called for the repeal of.

Letter Argument Against Salt Tax Repeal Misleading

Democrats Pressure Biden To Repeal Salt Deduction Cap

Marc Elrich Says Not So Fast On Salt Tax Cap Repeal

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

New York State Budget Provides A Work Around To The Federal Salt Cap For Certain Business Entities

Salt Cap Repeal Below 500k Still Costly And Regressive Committee For A Responsible Federal Budget

Note To Bernie The 8 Arguments For Restoring The Salt Deduction And Why They Re All Wrong

Salt Deduction Cap Durbin Duckworth Restate Call For Repeal In D C Memo Crain S Chicago Business

How Dems Can Get Out Of The Salt Mess And Save 1 Trillion

House Democrats Push For Repeal Of Rule Blocking Salt Cap Workaround

House Panel Votes To Temporarily Repeal Salt Deduction Cap The Hill

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union

Chuck Schumer Salt Deduction Cap Repeal Tax Bailout For Rich Liberals National Review

Salt Cap Foes Threaten Biden Tax Plan As Repeal Bid Gains Steam Bloomberg

What Is Salt Tax Deduction Mansion Global

N J Lawmakers Pepper Congress With Pleas For Salt Tax Break New Jersey Monitor

The Salt Outlook For 2021 Accounting Today

How A Change To The Salt Cap Would Affect Taxpayers By State Bond Buyer